When Fast Company Gives You an Award, Your Asset Isn't a Commodity

Let's be honest: most passive income "opportunities" involve commoditized assets anyone can buy. Rental properties that look like every other rental property. Dividend stocks that trade on the same exchanges as everyone else. No edge. No moat.

Go X scooters are different.

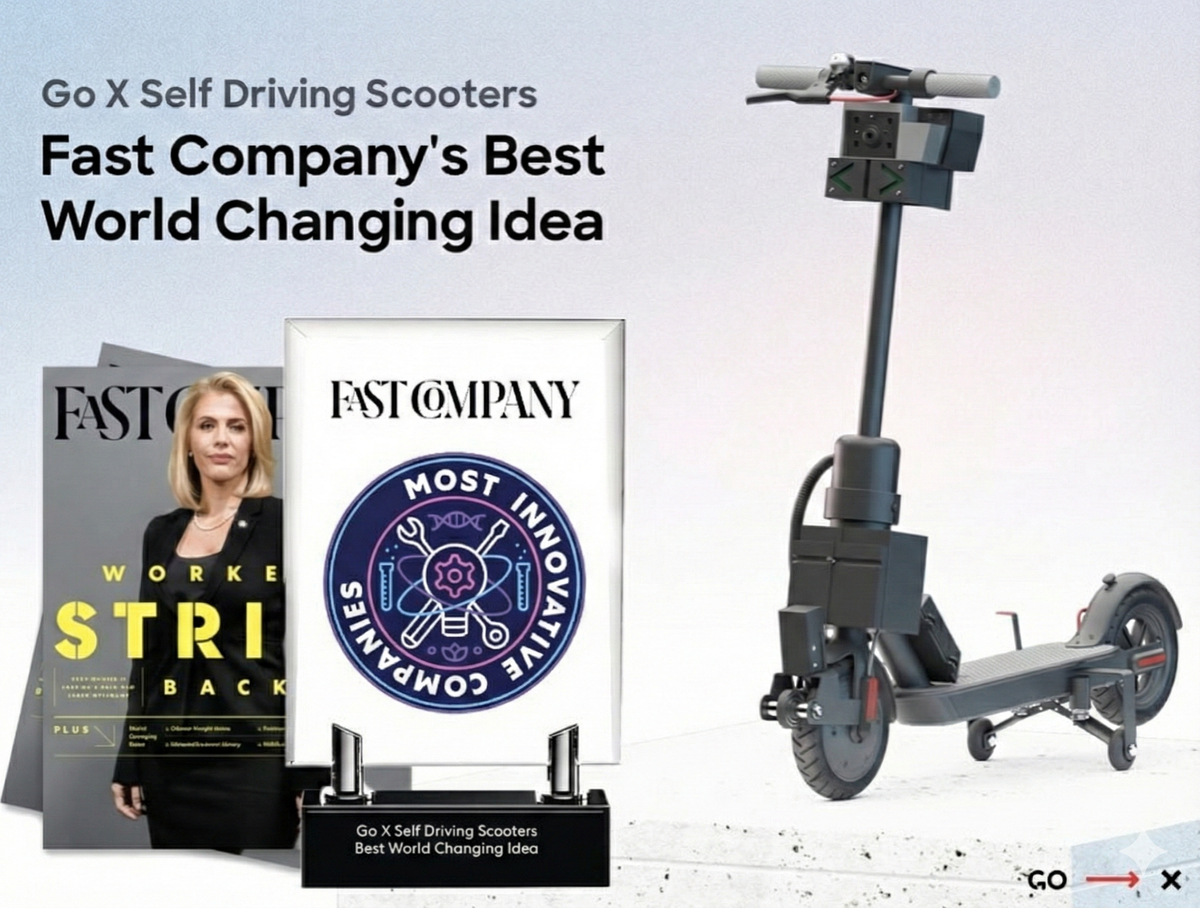

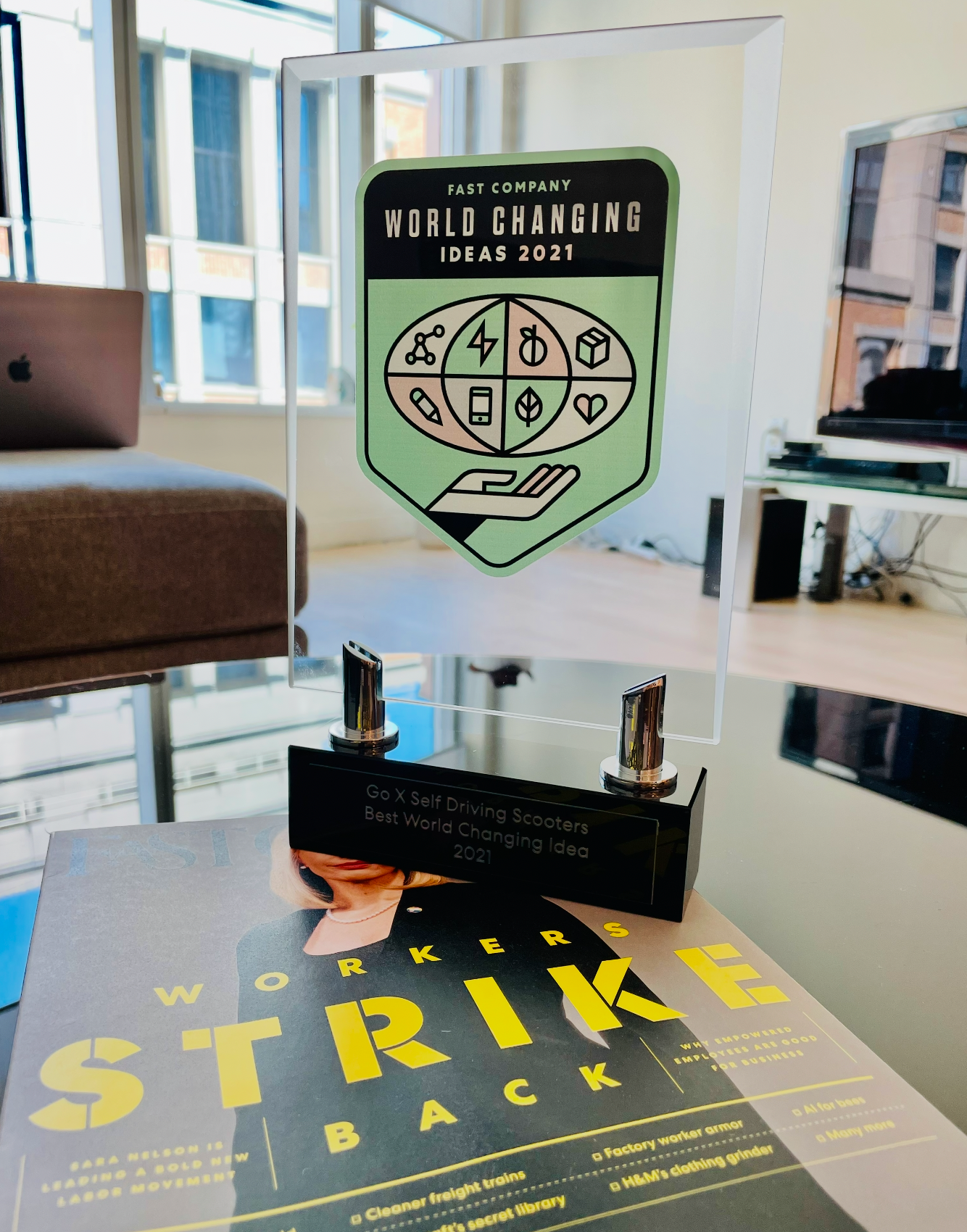

In 2020, Fast Company gave Go X a World Changing Ideas Award for deploying the world's first self-driving scooter fleet. The same publication that recognizes Microsoft, IBM, and Patagonia looked at Go X and said: this is innovation that matters.

When you invest through Medici, you're not buying generic scooters. You're buying into patented technology that competitors can't replicate.

The World's First Self-Driving Scooters

Here's what happened in Peachtree Corners, Georgia on May 20, 2020:

Go X launched a fleet of scooters that drive themselves.

Not a concept. Not a demo. A real, operational fleet where users could request a scooter through the app, watch it autonomously roll up to them, take their ride, and then the scooter would drive itself back to its home location.

Forbes lost their minds. Fast Company gave an award. The micromobility industry realized Go X wasn't just another scooter company—it was a technology company that happened to operate scooters.

Why this matters for your investment:

Self-driving technology solves the biggest cost problem in the scooter business: repositioning.

Traditional scooter companies pay workers to drive around in vans, collect scattered scooters, charge them, and redistribute them. It's expensive, inefficient, and burns cash.

When scooters drive themselves home, operating costs plummet. Lower costs = higher margins = better returns for investors.

Built Like Tanks, Ride Like Dreams

Let's talk about the hardware you're investing in:

| Specification | Go X Scooter |

|---|---|

| Weight capacity | 265 lbs |

| Range | 30-40 miles per charge |

| Component testing | 10,000+ miles |

| Build quality | Commercial-grade, not consumer |

These aren't the flimsy rental scooters you see abandoned on sidewalks. Go X scooters are designed for thousands of rides over multiple years.

Asset durability = investment protection.

When your scooter can handle 10,000+ miles before major maintenance, your cost-per-ride stays low and your yield stays high. This isn't a phone that becomes obsolete in two years. It's commercial infrastructure built to generate returns for the long haul.

The 24/7 Operations Machine

Technology isn't just about the scooter itself. It's about the entire operational system that keeps your investment productive:

Fleet Management System:

- Real-time tracking of every scooter

- Predictive maintenance alerts

- Automatic redistribution optimization

- Utilization analytics by location

The Florida Warehouse: A facility where the lights literally never turn off. 24/7/365 operation. When a scooter needs maintenance, it gets maintenance. When a fleet needs redistribution, it happens.

While you sleep, Go X operations teams are ensuring your asset is charged, functional, and positioned at high-demand locations.

The App Infrastructure:

- Smooth user experience (users don't abandon rides mid-checkout)

- Payment processing (revenue collection that actually works)

- Partner integration (businesses can track their performance)

- Regulatory compliance (geo-fencing, speed limits, etc.)

You don't see any of this. That's the point. The technology works so well that your only job is to check your Medici dashboard and watch returns accumulate.

Why Competitors Can't Catch Up

Here's the thing about technology moats: they compound over time.

Go X advantages that took years to build:

- Self-driving patents and know-how – You can't just "decide" to have autonomous scooters

- 4+ years of utilization data – Knowing exactly where to place scooters for maximum rides

- Partnership software – Integrated systems for 350+ business partners

- Regulatory relationships – Being named by cities as an approved operator

- Operational playbooks – How to launch 40+ locations in 30 days (like New Orleans)

A well-funded competitor could theoretically buy the same hardware. They can't buy the years of learning, the regulatory trust, or the technological lead.

When you invest through Medici, you're buying into a company that has already climbed the learning curve. Your returns benefit from innovations paid for by years of R&D—not out of your pocket.

Awards and Recognition

It's not just Fast Company. Here's what the industry has said about Go X:

- Fast Company World Changing Ideas Award – World's first self-driving scooters

- Featured in Forbes – Coverage of autonomous fleet technology

- Named by Treasure Island, FL – Specifically approved in city regulations

- Hawaii regulatory validation – 2021 legislation essentially modeled on Go X's approach

Third-party recognition matters because it's verification you can't buy. When publications, cities, and regulators validate a company, they're telling you: this is real.

The Technology Roadmap

Go X isn't done innovating. The company has already tested:

- The Dragon – A fully electric car for urban driving

- Human-carrying drones – Tested by Go X's CEO in Macau

- Expanded self-driving capabilities – Bringing autonomous features to more markets

What does this mean for your investment?

The same team that built the world's first self-driving scooter fleet is continuing to push boundaries. As technology improves, operating costs decrease. As costs decrease, your returns improve.

You're investing in a platform with a track record of innovation, not a static asset that depreciates and dies.

What Innovation Means for Your Returns

Let's make this concrete:

Traditional scooter company:

- High labor costs for repositioning

- Scooters scattered inefficiently

- Frequent maintenance from cheap hardware

- No technological differentiation

- Cities skeptical or hostile

- Burning cash, hoping to figure it out

Go X:

- Self-driving technology reduces repositioning costs

- Data-driven placement maximizes utilization

- Commercial-grade hardware lasts longer

- Awards and recognition build trust

- Cities actively approve operations

- Profitable on a seed round

The difference in unit economics flows directly to investors. When your scooter costs less to operate and generates more rides, your yield improves.

Technology isn't just a buzzword. It's the reason Go X built the #1 position in four states while better-funded competitors went bankrupt.

Your Investment in Innovation

When you invest through Medici, you're not just buying a piece of metal and batteries. You're buying into:

- Award-winning autonomous technology

- Commercial-grade hardware built for 10,000+ miles

- 24/7 operational infrastructure

- A team that out-innovated companies with 50x the funding

This is what separates real passive income from gimmicks. Real assets, backed by real technology, operated by real experts, generating real returns.

The scooters of the future are already here. Own a piece.