How Go X Turned "Legal Limbo" Into a Competitive Fortress

In February 2021, Go X launched in Waikiki with 100 scooters. At the time, electric scooters were technically classified as mopeds under Hawaii law—a gray area that made most companies stay away.

Go X went anyway.

By the time Hawaii passed landmark legislation later that year, the regulations essentially validated Go X's entire business model. The company that took the risk became the company that set the standard.

This is what a regulatory moat looks like. And when you invest through Medici, your capital is protected by it.

Why Regulation Matters for Your Returns

Most investors don't think about regulation until it destroys their investment.

- Airbnb investors got crushed when cities cracked down on short-term rentals

- Cannabis investors watched portfolios evaporate as regulations shifted

- Crypto investors faced uncertainty as governments figured out their approach

The scooter industry already had its regulatory reckoning. Companies like Bird and Lime flooded cities with scooters, ignored rules, angered residents, and burned through hundreds of millions fighting losing battles.

Many cities banned scooters entirely. Others created regulations so strict that operations became unprofitable.

Go X survived—and thrived—because it built a model that regulators actually liked.

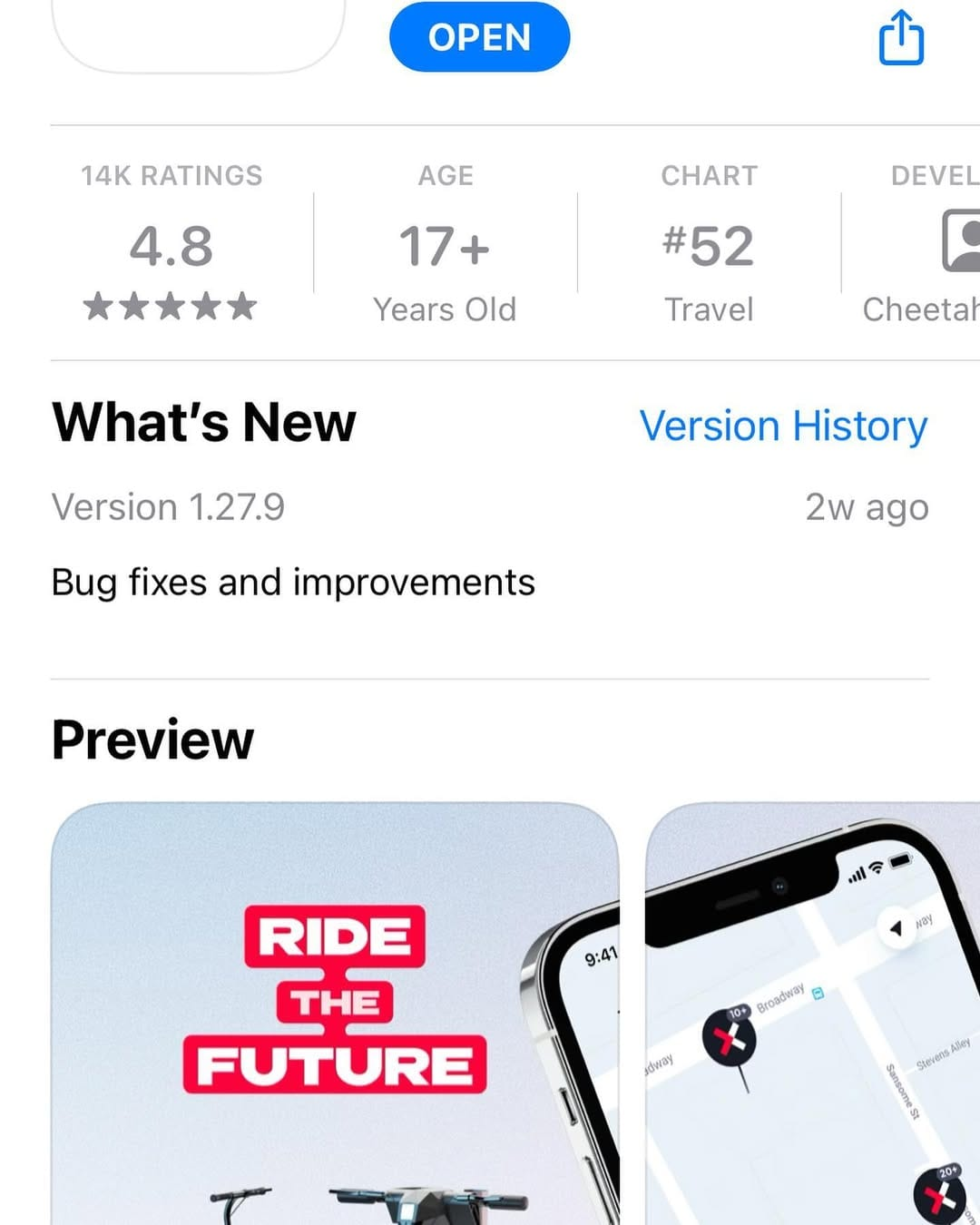

Go X Scooters Became #1 in Top MicroMobility Cities

The B2B Model Cities Love

Here's why cities that rejected Bird and Lime approved Go X:

Traditional scooter companies:

- Dump scooters on sidewalks

- Create pedestrian hazards

- Generate resident complaints

- Fight cities on regulations

- Leave broken scooters everywhere

- No accountability

Go X's approach:

- Scooters stationed at designated partner locations

- Off sidewalks, out of the way

- Partners responsible for oversight

- Proactive regulatory compliance

- Professional maintenance 24/7

- Accountable to both cities and partners

When Treasure Island, Florida updated their micromobility ordinance, they specifically named Go X as an approved operator. Not because of lobbying. Because Go X had demonstrated what responsible scooter operation looks like.

That kind of regulatory relationship can't be bought. It's earned over years. And it protects your investment from competitors who show up later.

Hawaii: The Case Study

Let's walk through how Go X built its Hawaii moat:

February 2021: Launch in Waikiki with 100 scooters. Technically operating in legal gray area.

Throughout 2021: Build partnerships with local businesses. Demonstrate responsible operation. Zero sidewalk chaos. Zero resident complaints.

Late 2021: Hawaii passes legislation clarifying scooter regulations. The new rules? They essentially describe exactly how Go X was already operating.

2022-2025: Expand to 90+ partner locations across Oahu. Achieve 1.5 million miles. Become the only 24/7 scooter operator in Hawaii.

Today: First-mover advantage is locked in. New competitors would face:

- Strict regulations designed around the incumbent model

- An established partner network with no reason to switch

- A customer base already familiar with Go X

- Regulatory relationships built over 4+ years

This isn't a moat that erodes. It's a moat that deepens.

The Multi-State Advantage

Go X didn't just nail Hawaii. The company is the #1 scooter operator in four different states:

| State | Regulatory Status | Competitive Position |

|---|---|---|

| Hawaii | Legislation aligned with Go X model | Only 24/7 operator |

| Florida | Named approved operator in Treasure Island | 80+ beach community partners |

| Louisiana | Full compliance | Fastest launch ever (40+ locations in 30 days) |

| Nevada | Operating within Las Vegas regulations | Growing Strip presence |

Each state validates the model independently. Different regulatory environments, different local politics, different market conditions—same result: Go X wins.

When you invest through Medici, you're investing in a company that has proven it can navigate regulation in any environment.

Why New Competitors Face an Uphill Battle

Imagine you're a new scooter company looking at Hawaii in 2026:

To compete, you'd need to:

- Navigate regulations written for an incumbent

- Convince 90+ businesses to abandon a working partnership

- Build operational infrastructure from scratch

- Establish regulatory trust that took Go X years to earn

- Match 4+ years of utilization data and optimization

- Somehow be more attractive than a proven, profitable operator

You'd need massive capital just to enter—and you'd be fighting uphill the entire time.

This is what first-mover advantage looks like when it's protected by regulation. Your investment isn't competing in an open market. It's protected by barriers that get higher every year.

The Compounding Nature of Regulatory Trust

Here's something investors often miss: regulatory trust compounds.

When Go X succeeds in Hawaii, it makes the Florida pitch easier: "Look at our track record."

When Florida goes well, Louisiana is even easier: "We're the #1 operator in multiple states."

When every new city sees a pattern of success, the regulatory conversations shift from "convince us you won't cause problems" to "we've heard good things, let's talk partnership."

This flywheel accelerates expansion while simultaneously raising barriers for competitors.

Protection You Can't Buy

Let's compare different passive income investments on regulatory risk:

Rental Properties:

- Zoning changes can kill value overnight

- Rent control can cap your returns

- Short-term rental bans can eliminate strategies

- Each property is individually exposed

Dividend Stocks:

- Industry regulations can crush entire sectors

- Individual companies can face enforcement

- You have zero control or visibility

Go X Scooters Through Medici:

- Regulatory relationships built over 4+ years

- Model designed with cities, not against them

- Named as approved operator by local governments

- Track record of compliance in 4 states

- First-mover advantage locked in

Your investment is protected by a moat that competitors would spend years and millions trying to breach—and they'd probably fail.

The Bottom Line

Passive income is only passive if your investment is protected.

Go X spent years building a regulatory fortress around its operations. When Hawaii passed scooter legislation, it validated Go X's approach. When Treasure Island wrote micromobility rules, they named Go X specifically.

These aren't accidents. They're the result of:

- Operating responsibly from day one

- Partnering with local businesses instead of fighting cities

- Building relationships with regulators instead of ignoring them

- Proving the model works—across four different states

When you invest through Medici, your capital sits inside this fortress. You're not hoping regulations go your way. You're investing in a company that already shaped them.

That's the difference between speculation and investing.